May Pera Ka Ba?

I am a businessman and I made my first million at the age of 22. Akala ko noon, ang pinaka-importante sa buhay ay ang maging successful sa career o sa negosyo kaya naman ginawa ko ang lahat upang umangat ako. Marami na akong nasubukang iba’t ibang negosyo, mula sa trading, manufacturing, kiosks, at direct selling. Hanggang sa pinasok ko ang restaurant business at doon nga nawala ang lahat… Sa edad na 30, naubos lahat ang ipon naming mag-asawa at nagka utang-utang pa nga. Kasama ang ilang business partners, nawalan kami ng ten million pesos at nagkaroon pa ng utang na 2.5 million pesos. Ngunit noong December 2010, through God’s grace, nabayaran namin ang aming pagkakautang.

Ang nangyari sa amin ay nakatulong upang maging mas mapagkumbaba ako at mapagtantong mayroon akong mga limitasyon; at ngayon ngang alam ko na ang aking mga limitasyon, nakabuo ako ng mas makatotohanang strategy para sa aking personal at financial growth. Tandaan na ang personal finance ay 80% Behavior at 20% Knowledge.

Naranasan ko na ang mga ups and downs sa buhay. Ang isang sign ng taong marunong sa pera ay iyon ngang taong marunong mag-adjust sa sitwasyon; iyong marunong magtipid sa oras na nag-uumpaw ang biyaya at marunong magsikip ng sinturon kapag oras ng kagipitan. Hayaan mong bigyan ko kayo ng tips kung ano ang maaari ninyong gawin para matuto at unti-unti kayong makapag-adjust at nang ang inyong pera ay hindi lang maging sakto o sapat – hayaan itong maging siksik, liglig at umaapaw!

1) Gumawa ng Budget

Magplano at isulat mo ito. Kapag hindi mo ‘yan isinulat, para ka lamang nagsulat sa tubig. Kung ang mga kumpanya nga ay mayroong financial statement, maaari tayong matuto sa kanilang gawi.

Gumawa ka ng budget at mas maigi kung kasama si mister. Sa totoo lang, kailangan ninyong pag-awayan ang budget niyo. Alamin kung ano ba talaga ang inyong needs and wants; baka kay mister, ang pakikipag-inuman sa barkada is a need and kay misis, ang shopping naman ay need. Pag-awayan niyo na ang budget niyo dahil mas maganda na mag-away ng isang beses imbes na mag-away kayo araw-araw kapag kinapos na sa pera.

Ang paggawa ng budget ay hindi natatapos sa isang upuan. Maaaring abutin nga ng ilang buwan bago niyo talagang magawa o mabuo ang tamang budget para sa inyong pamilya; kaya naman maiging pag-usapan ninyo itong mag-asawa at least once a week sa loob ng dalawang buwan at matapos nito, maaaring pag-usapan niyo ito kada buwan kung magkakaroon ba ng adjustments o kung ano pa man.

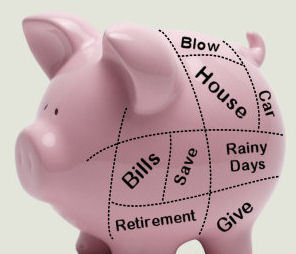

Ang budget nga ay maituturing natin bilang isang mapa at kailangan ngang isulat mo muna kung saan ba dapat mapunta ang iyong pera bago mo pa ito makuha. Isama mo ang perang itatabi mo at ang perang ilalabas kahit na ba ang mga binabayaran mo kada taon tulad na lamang ng insurance kung mayroon ka man. Tandaan, isulat mo iyan!

2) Maghanap ng Extrang Pagkakakitaan

Maghanap ng maaaring maging sideline na business. Magsimula lamang sa maliit para hindi ka mabigla. Pwedeng magtinda ka ng mga pagkain o di kaya mag-buy and sell. Lalo na nga kung Pasko, maaari kang magbenta ng mga gift items, imitation perfume, slippers at iba pang bagay na in ngayon.

O di kaya, tumungo ka sa iyong silid at tingnan mo ano nga ba ang mga bagay na hindi mo na ginagamit baka naman maaari mo pa itong ibenta! Ang tawag nga diyan sa corporate world ay liquidation. Magbenta kayo ng magbenta ng mga gamit na hindi niyo kailangan hanggang matakot na ang mga anak niyo na sila na ang susunod.

3) Bawasan ang Gastos

Ito nga ang sinasabing formula kung nais mong maging financially free: “Spend less than you earn, and do it for a long time, then you can be financially free.” (Gumastos ng mababa pa sa iyong kinikita at gawin ito ng matagal at ikaw nga ay magiging financially free)

Ang mga tunay na milyonaryo na walang utang ay hindi magarbo kagaya ng ating iniisip.

Bihira nga silang bumili ng bagong sasakyan at mas gugustuhin pa ang mga second hand na sasakyan. Bakit ‘ka mo? Dahil ang bagong sasakyan, sa oras na ilabas mo ito sa casa, babagsak na agad ang halaga nito ng halos 20% dahil nagamit mo na. Ang tawag diyan ay depreciation.

Kagaya ng magagarang sasakyan ay huwag ka ring magpadala sa mga latest gadgets na inilalabas. Lahat nga ng mga bagong gadgets na iyan ay bababa ang value sa loob lamang ng ilang buwan. Naalala ko nga nang unang lumabas ang iPad ay nagkakahalaga ito ng P45,000; pero makalipas lamang ang ilang buwan ay bumaba na ang presyo nito sa P26,000. Kung ilalagay mo sa banko ang P26,000 mo ng 10 taon ng may 1% rate per annum, hindi ito aabot ng P45,000. Be patient! Huwag magpadalos-dalos sa mga desisyon!

4) Ipunin ang Pera

Sabi nga sa Bibliya, “He who gathers little by little makes it grow.” Kaya naman mabuting ipunin mo ang, at least, 10% ng iyong kinikita.

Mahalagang magkaroon ka ng emergency fund. Ang emergency fund ay dapat katumbas ng 6-8 buwan ng iyong living expenses at nakatabi lamang ito sa bangko. Kapag ang living expenses mo ay P25, 000 a month, sa loob nga ng 6 na buwan ay kakailanganin mo ng P150,000 na emergency fund.

Bakit nga ba natin kailangan ng emergency fund? Hango nga sa salitang emergency, ito ay makatutulong upang hindi kayo mabigla sa mga gastusin, halimbawa na lamang na magkasakit at ma-ospital ang inyong anak. Hindi ba’t medyo malaki ang gastos? Ano ang gagawin natin? Ang madalas na ginagawa natin ay mangungutang tayo sa kaibigan o kamag-anak pero kung may emergency fund ka, doon mo na kukunin ang gagastusin sa ospital.

O di kaya kapag nawalan ng trabaho si mister ng ilang buwan, saan kayo kukuha ng pera? Tama, sa emergency fund. May 6 months ka pa bago maubusan ng pondo at sapat na itong panahon upang makapaghanap muli ng trabaho si mister. Buuin muna ang inyong emergency fund bago niyo bilhin ang anumang luho niyo para sa oras ng kagipitan, mayroong maayos na makakapitan.

5) Kumawala sa Utang

Sinasabi ngang getting out of debt is a test of character. At kung mapapasa mo nga ang test na ito, mas mapagkakatiwalaan mo ang iyong sarili at gayun din naman, mas madali mong makukuha ang tiwala ng iba; at syempre, kapag pinagkakatiwalaan ka na ng tao, madali nang mag-negosyo.

Nagawa nga namin ng asawa ko na bayaran ang aming P2.5 million na utang sa loob ng dalawang taon. Sa totoo lang, hindi ko alam kung paano namin ito nagawa. Tuwing magkakaroon kami ng additional income, nagbabayad kami para sa aming utang maging malaki o maliit man ang aming hulog. Mayroon nga kaming walong credit cards noon at lahat nga iyon ay may utang. Nang nagbigay nga ako ng speech sa harap ng 300 katao noong December 2010, itinaas ko ang huli kong unpaid credit card at sinabi ko ngang, “this is plastic surgery.” Ginupit ko ito sa harapan at sumigaw ako ng FREEDOM. Ang makawala sa pagkakautang ang isa sa pinakamasarap na maaari mong maramdaman.

Hindi ko na sinama ang tungkol sa investing dahil iba na ang paksang ito. Pero sa oras na matapos o masunod mo na ang mga nasasaad dito, ay maaaring mag-simula ka na sa pag-iinvest.

Ang huling maipapayo ko sa inyo ay maiging ibahagi ninyo ang inyong pera. Itabi na ang 10% ng inyong income para sa tithes. Magbigay sa simbahan o di kaya sa isang organisasyon na maaaring nangangailangan nito. Tandaan mo na “It is more blessed to give than to receive”)